Along with bank reconciliations, cash flow analysis provides guidance on how the district can cover expenditures in the near and upcoming future. There are different methods of looking at cash flow.

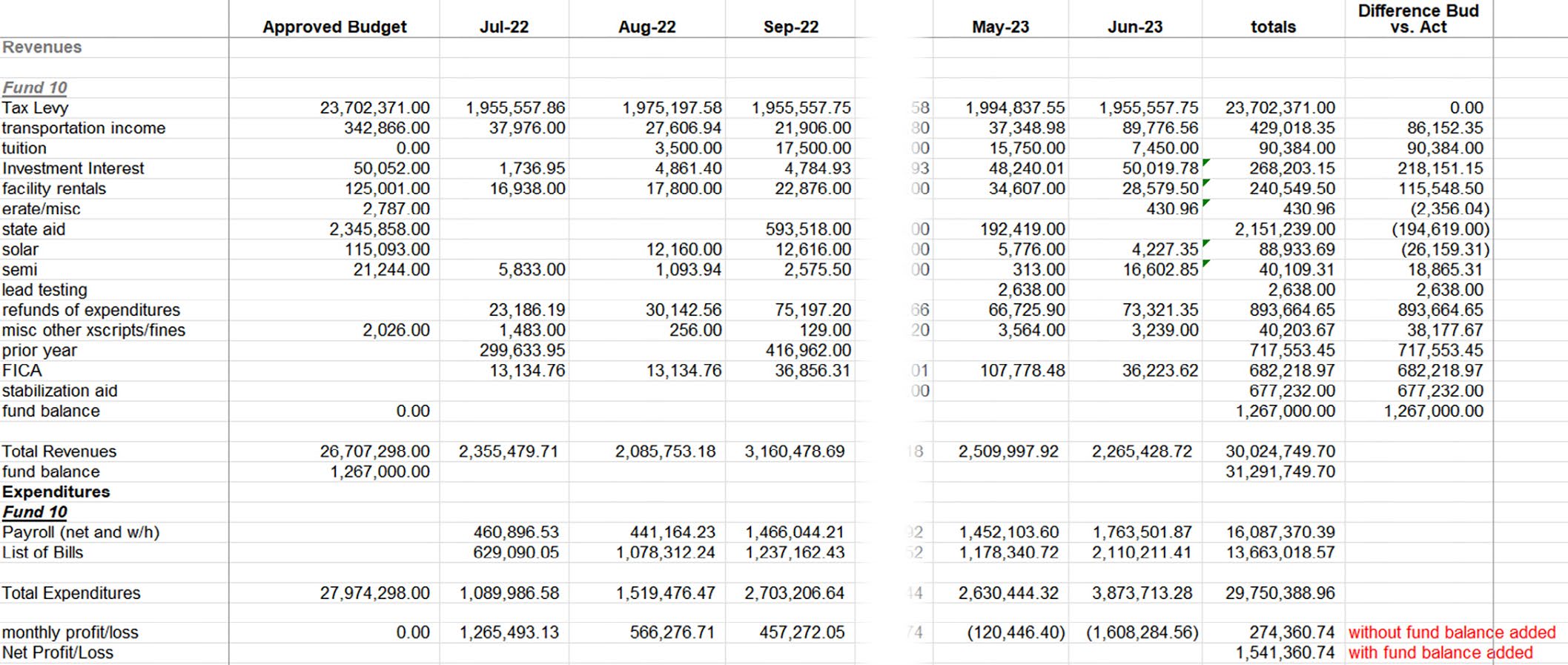

In this scenario, the budgeted revenues and expenditures are input as a guide, and then compared with actual revenues and expenditures monthly, calculating the differences (Figure 1).

The cash flow at the bottom of Figure 1 provides a broad look at revenues and expenditures on one page. This worksheet also provides additional guidance on whether your budgeted revenues are sufficient for the year, and whether any shortfalls in revenues will occur the upcoming months.

Pro: This worksheet is simple and easy to use for budgeting purposes.

Con: It may not resolve what you are looking for regarding cash flow analysis.

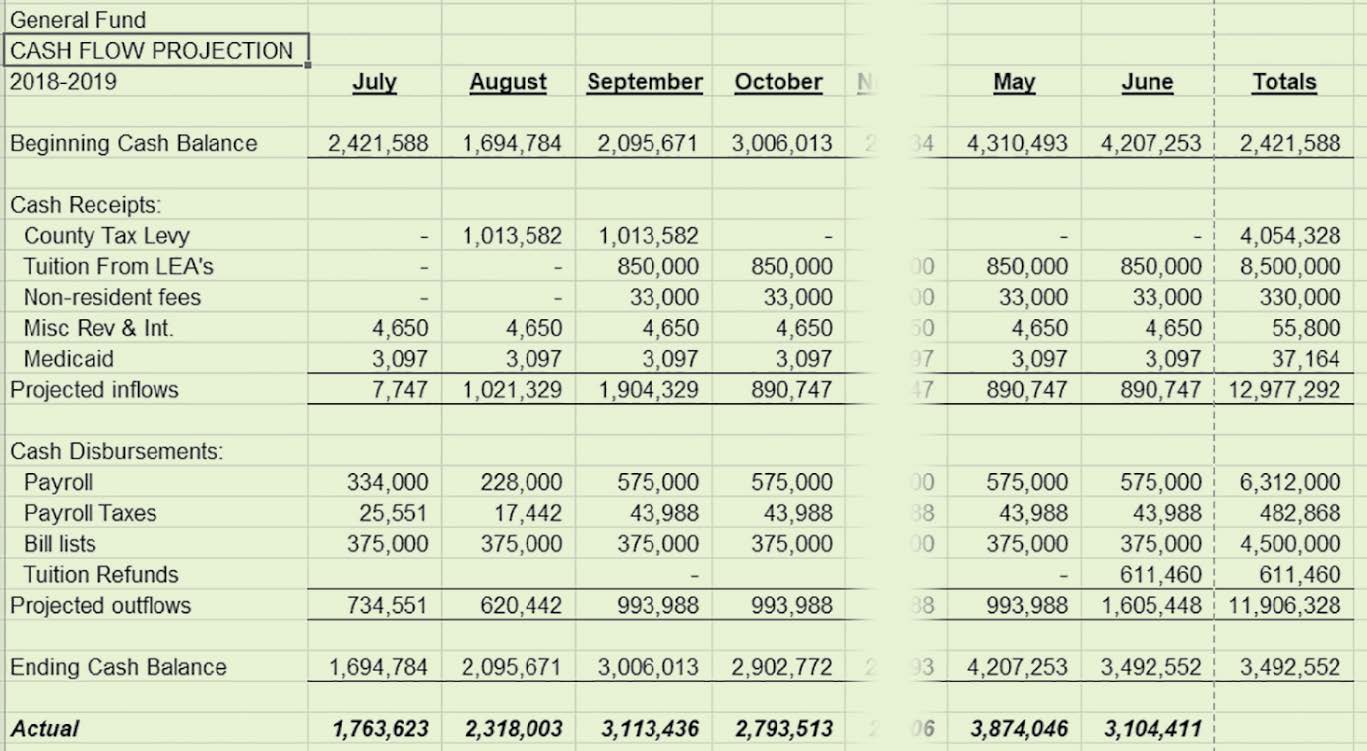

In this example, cash balances are used for comparison with estimated revenue and expenditure activity throughout the year. The opening cash balance (live) is then calculated throughout the estimates provided for the year.

The bold numbers in Figure 2 are the actual cash balances throughout the year. The district can estimate the needed monthly cash balance based on the inflow and outflow activity. In this example, the business official can determine whether any changes in scheduling of receipts are necessary to adjust for the expenditures estimated for that month.

Pro: This worksheet is another easy and valuable cash flow tool that allows you to plan ahead of an estimate of the cash needed each month for the upcoming year.

Con: The actual expenditures and receipts are not used.

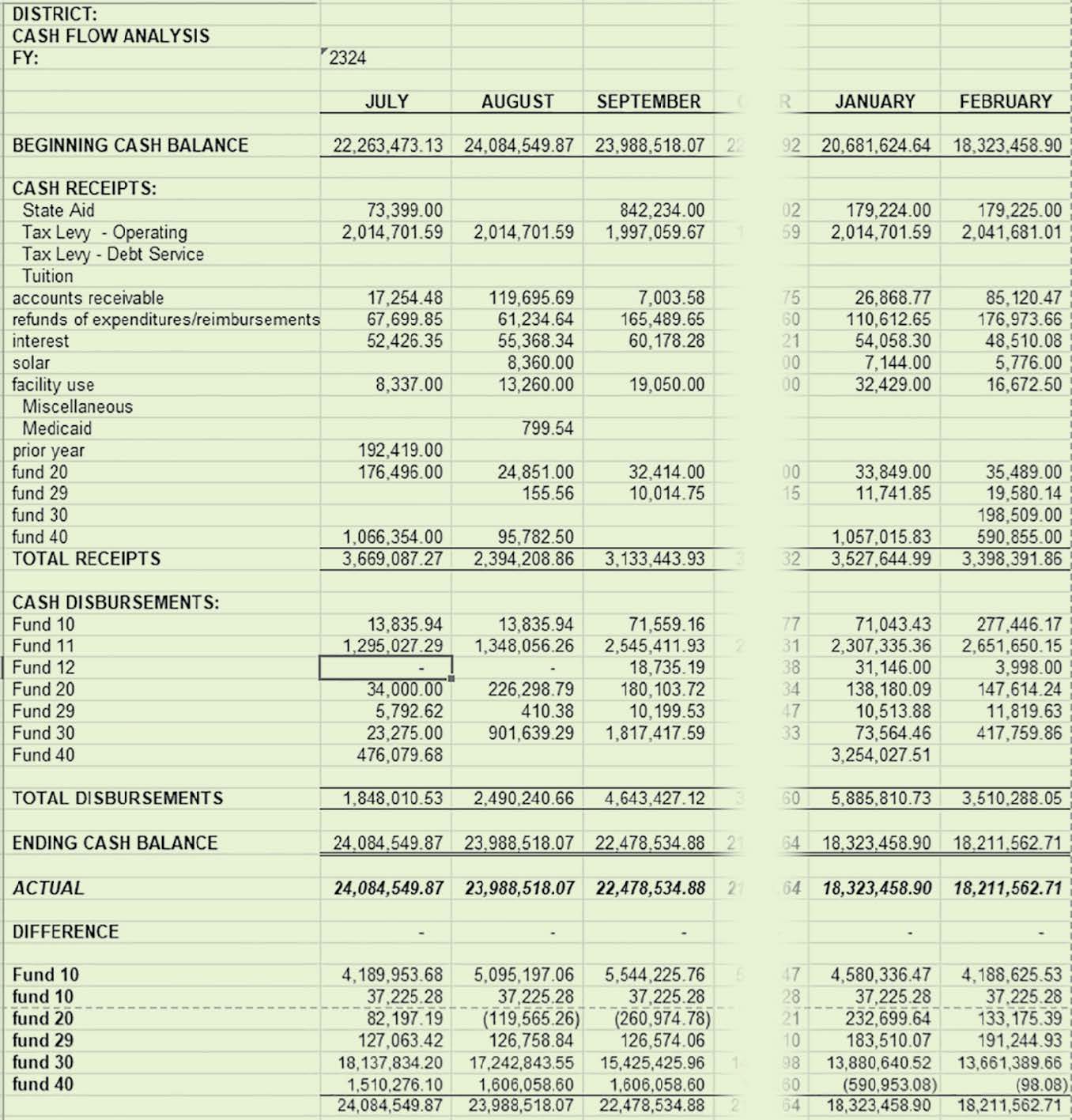

In Figure 3, the opening cash balance is used, and each month an accounting of cash is completed, tying out to the cash balances that make up the general fund. The information is reconciled to the board secretary report cash balances.

Pro: This strategy incorporates everything: cash, receipts, and expenditures. It is an excellent report to add to the monthly work. A column displaying the budget information can be added for comparison purposes.

Con: Although the work may appear repetitive, it is worth the time.

Additional Scenarios

Another example of analysis is multiyear budget planning. Converting a summary worksheet of revenues and expenditures and adding estimated percentages to the account lines will result in a baseline projection model. The adjustments can be as detailed or as broad as needed. Using prior actual expenditures will also enable additional data (found in exhibit J-4 of the Annual Comprehensive Financial Report) to support the work.

Now that cash flows are monitored, what options can a district with excess cash use to earn interest?

Investment of district funds is governed by state and federal regulations (the Governmental Accounting Standards Board, for example). A district can invest funds; however, it is highly recommended that you as the business official seek advice from your district’s legal counsel, auditors, or financial advisers.

Cash flow and investing are two areas that fall into the “financial management” column of the business official responsibilities worksheet. For new business officials, or for experienced business officials who are newly employed in a district, looking at cash flows can be the first step to understanding whether action must be taken to freeze spending, or whether the district is on target with its monthly spending. The worksheets may take time to compile, but they will be an excellent source of data when giving a financial overview of the district.

Figure 1. Budgeted vs. Actual Cash Flow

Figure 1. Budgeted vs. Actual Cash Flow

Figure 2. Budget Projections with Cash Balances

Figure 2. Budget Projections with Cash Balances

Figure 3. Cash Balances Tied to the Board Secretary Report

Figure 3. Cash Balances Tied to the Board Secretary Report