The Audit Program – Read It

Each state publishes an audit guideline manual for school districts. This manual includes general information about changes from the previous year, general compliance, specific compliance, proprietary funds, fiduciary funds, reporting, etc.

The audit program details everything the auditor and the business official should know, have ready, and follow regarding all financial funds for their district.

The audit program details everything the auditor and the business official should know, have ready, and follow regarding all financial funds for their district. The program is lengthy – New Jersey’s Audit Program for 23/24 school year is 383 pages but each page contains essential information.

Whether you are a seasoned veteran or a brand-new business official, read this guide and use it to confirm if entries are made correctly, sub schedules are up to date, and what reports are needed for the auditors.

Schedule with the audit team for the days when they will be in-district for field work/testing. Ask them what they will need from you so you can have the files waiting for them when they arrive. If you are in a small district, the files may be in your workspace; if you are in a larger district, the files may need to be requested, such as personnel folders or payroll documents.

Inform key employees in the business office that the auditors will be in-district, and to make sure their work for the auditors is completed and accessible to you prior to the auditors’ arrival. This is where technology is a wonderful tool – having shared cloud files will make things easier if someone is out and you need to find the particular file.

Provide Adequate Workspace

Ensure the auditors have sufficient workspace – either a conference room, classroom, or unused office. Access to Wi-Fi and electrical outlets is also necessary. Having the audit workspace near the business office will make the process easier and more efficient for everyone.

When the auditors are in, plan your time to allow for necessary discussions, additional information searches, phone calls, and after-hours work so the audit team can stay on their schedule.

While there are transactions and tests that the auditors will perform on-site, you can prepare some of items throughout the year and ahead of the audit:

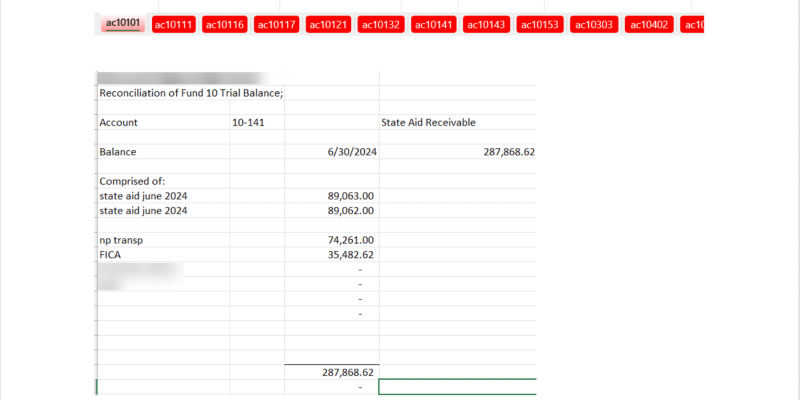

Worksheet Audit File: This worksheet file has a detailed account analysis of all major balance sheet accounts. See Figure 1.

While this same report can be achieved by running a detailed general ledger analysis of the particular account, this lead sheet will serve as a confirmation of the general ledger balance.

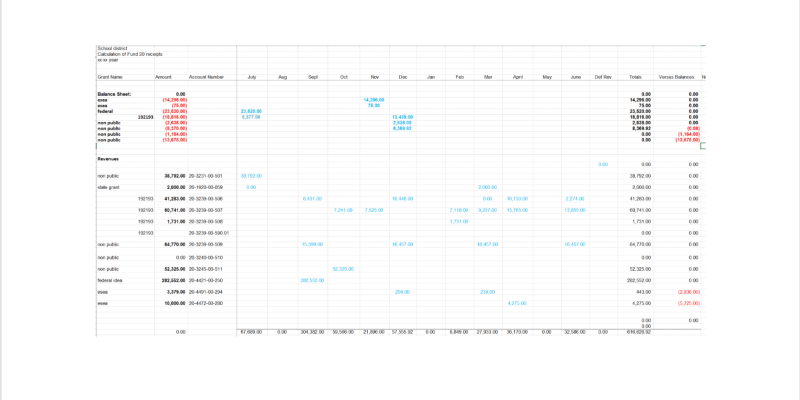

For grants, a cash reconciliation worksheet will function as a double check to confirm receipts were posted to the correct grant account line.

Figure 2 is an example grant worksheet. On the left top are the balance sheet receivables. Below are the revenue items for the current year. As the cash comes in, the receipt is matched up to the particular grant.

At the end of the year, you now have a detailed accounting of the total received.

While this report may seem redundant, as you can print this information from your accounting system, it is a nice broad overview (balance sheet and revenues together on one form) rather than trying to switch from one file to another.

Information Auditors Need to Know: Throughout the school year, the district may encounter unique items such as a grant audit, food service review, or receive additional aid/grants. When that occurs, make additional copies of correspondence and/or board resolutions for the auditors so they are aware of the events that they may need to include as part of the audit report. These copies can be electronic or paper.

Additional items such as changes in financial institutions, taking on new debt, real estate transactions, or insurance/legal matters should also be put into the file for review. With the multitude of decisions that take place every day as a business official, it is possible to forget a particular event. This file can make your life as a business official easier, even if it is for five minutes.

Conclusion

Being ready for the district audit allows school business officials to stay focused on other tasks that need to be accomplished before quitting time. Tennis great Arthur Ashe said “One important key to success is self-confidence. An important key to self-confidence is preparation.” Being prepared for the annual audit may be what you are looking for to strengthen your experience.

If you feel that your financials are exemplary, I encourage you to apply for the ASBO International Certificate of Excellence in Financial Reporting Award.

If you are not ready to apply for the award, click on the Resources section and review what is needed to obtain the certification. Completing this process will invite more professional/personal experience for you and for the district team members.