We must be able to prioritize budget items and maximize our budgets in real time in order to provide our students with a high-quality education and to develop essential programs that address their needs.

To successfully navigate between these overlapping budget demands, Missouri’s Ladue School District developed a financial framework that models the impacts of current and future economic variables on the existing budget and the mid- and long-term financial forecast. We can look at the long-term financial impact of funding a one-time project or ongoing initiatives and couple that with changes in the economic climate.

Based on a requirement for additional instructional programming and the volatility surrounding the economy and inflation, this tool has become a crucial part of our budgeting process.

The Ladue School District is located in the suburbs of St. Louis and serves approximately 4,400 students. Even though the district is only 19 square miles, it serves students from 10 different municipalities with varying commercial and residential tax bases. Ladue is 94% locally funded through taxes associated with real estate, commercial, and personal property assessments. Currently, the Ladue School District has a strong financial position, with revenues and expenditures increasing moderately every year.

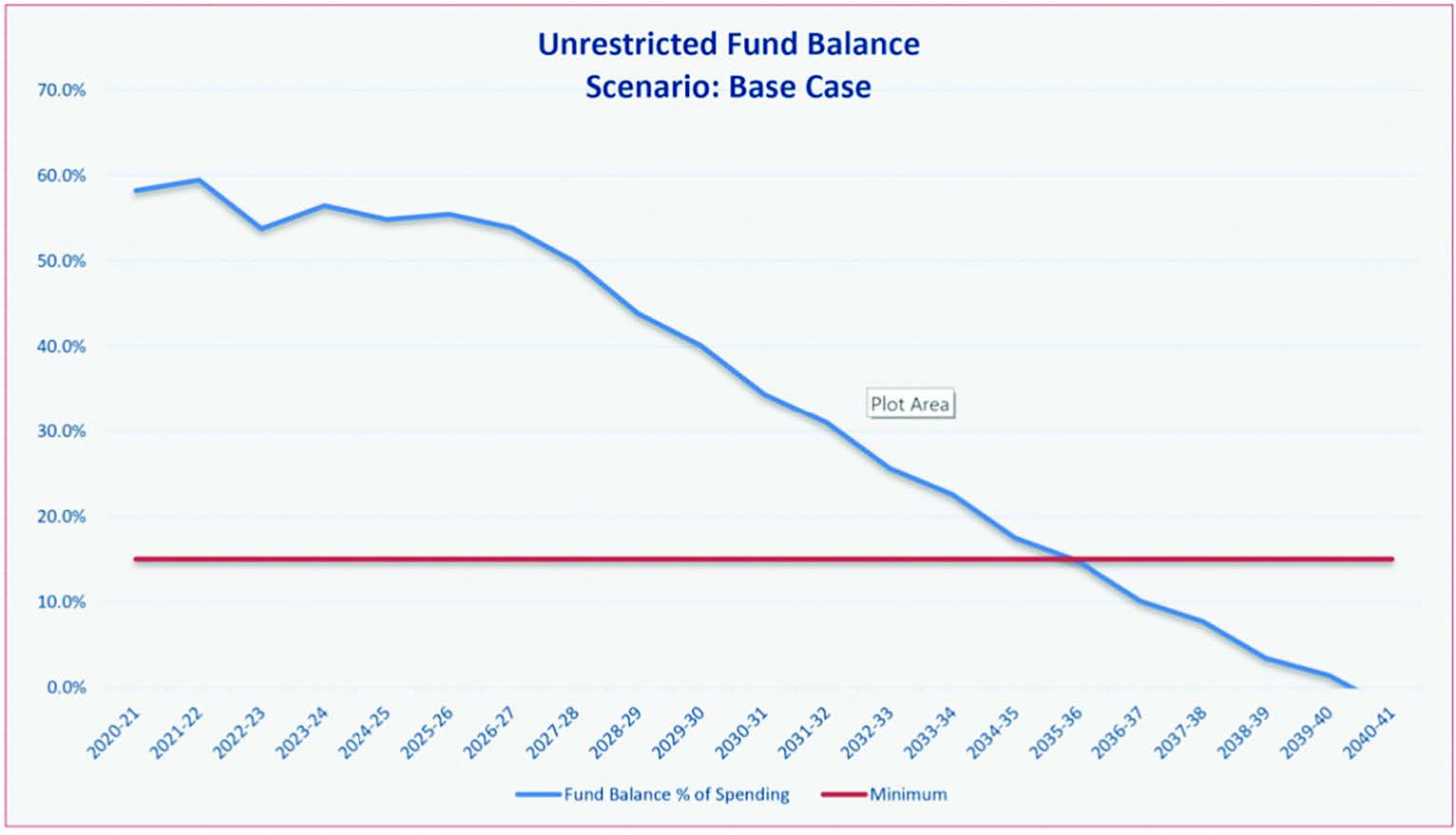

Unrestricted fund balance scenerio

Unrestricted fund balance scenerio

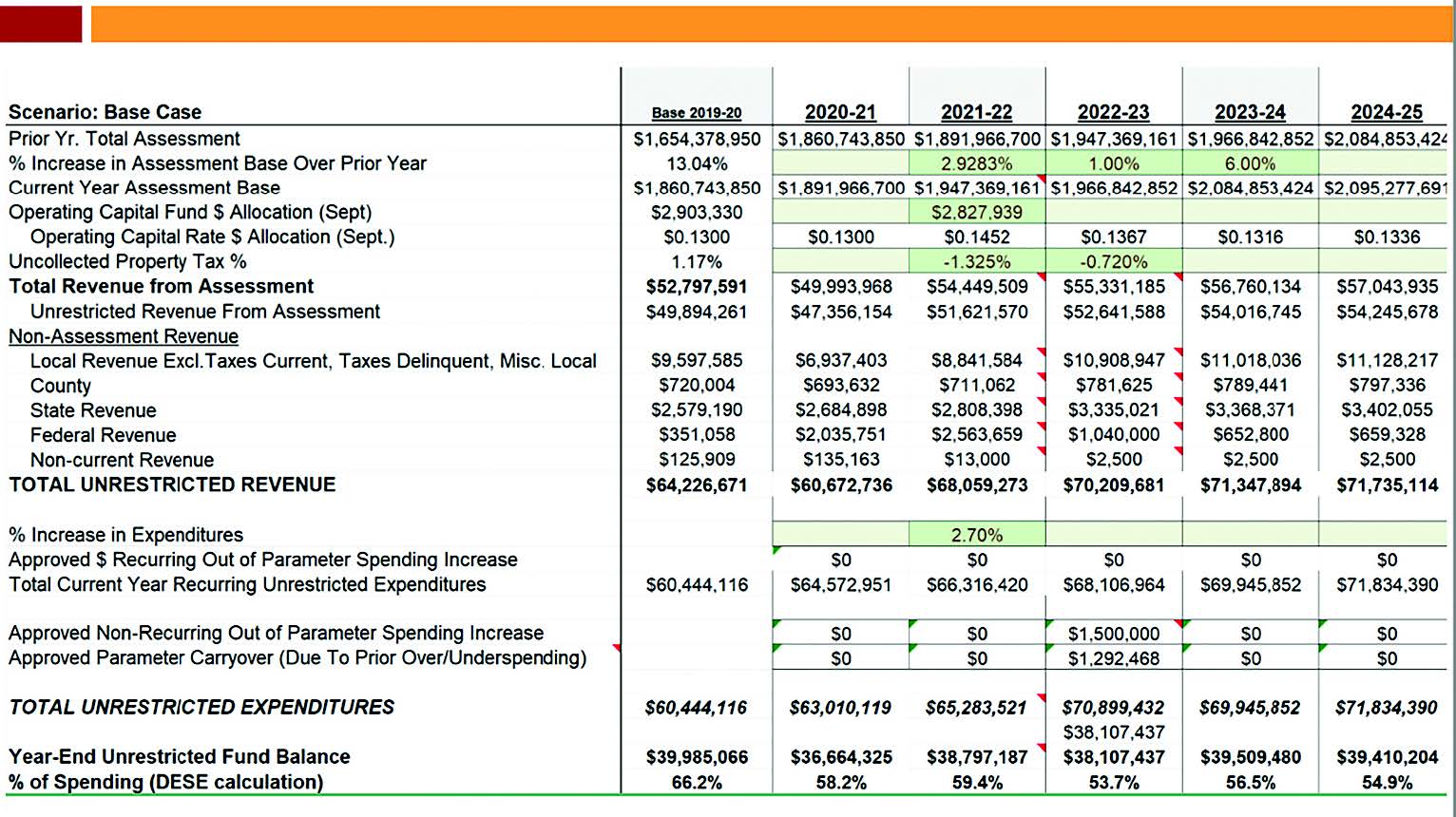

Calculations based on Base Case Scenario

Calculations based on Base Case Scenario

Establishing a Strategy

Over the past decade, the district has worked to build and maintain a healthy fund balance that can withstand the volatility of today’s economy. Ten years ago, the finances looked very different. At that time, assessments were declining, and enrollment was increasing. The buildings were becoming crowded, and the infrastructure was aging and already outdated.

Historically, the community had been averse to operating tax increases. Even though the community didn’t embrace the idea of increasing taxes, they supported a tax increase of $0.36 per $100 of assessed valuation. With voter approval of the levy came the understanding that the district would cut $6 million in expenditures and, moving forward, develop sound budgeting practices so that future levy increases wouldn’t be necessary.

Once the taxpayers passed the levy, the board of education and administration worked together to develop a long-term financial management strategy. Collectively, the board and administration were committed to the following:

- Making student-centered decisions.

- Providing staff with the necessary resources to deliver high-quality instruction effectively.

- Introducing consistent improvements to curriculum and instruction for all students.

- Executing “game-changing” programs.

- Building and maintaining future-ready schools.

- Ensuring financial stability while being good stewards of the tax revenues entrusted to the district.

The levy increase would enable the district to address many of these commitments, but the levy alone wouldn’t be enough. The district had to develop a sound financial plan. Knowing that the district’s commitments would continue to generate additional annual expenses, we put strategic financial goals in place to address short-term, intermediate, and long-term planning driven by key financial data.

The framework has become the foundation of our district’s financial planning and decision making.

Short term. The budget uses the most current one-year projections and provides the administration with an opportunity to support educational programming that aligns with the approved annual goals. At the conclusion of the fiscal year, the year-end data are provided so planned income and expenditures in the new year can be compared with actual prior-year information.

Intermediate. The board-approved annual spending parameters cover a four-year budget cycle. The four-year cumulative spending parameter feature provides predictability on financial resources that will be available in upcoming years and budgeting flexibility between years.

Currently, the administration is wrapping up the third parameter cycle with the approved annual spending increase of 2.7% for operating expenses and 2.0% for capital expenditures. Maintaining these annual and cumulative parameters has allowed the administration to take advantage of the timing of expenditures for program innovation while increasing and maintaining an adequate fund balance (surplus).

Long term. Short-term, mid-term, and long-term forecasts are developed using all of the district’s key financial data. These data are loaded into a dynamic district cash flow model that calculates the effects of different financial scenarios based on the fluctuation of annual expenditures and revenues. Updating the model and analyzing the forecasts allow us to plan incremental investments in major district initiatives while understanding the potential long-term financial impacts.

Our model was developed to extend to 2040–2041, with the understanding that financial conditions can change quickly and adjustments may need to be made in real time. Extending our forecast that far demonstrates to our community that we have a financial plan for our future. It also provides us with data to educate our community and staff about our current spending patterns and fund balance.

Since the parameters have been implemented, the district’s annual expenditures have increased even if the projected revenues in any budget year did not. This type of budgeting insulates the students and community from years in which revenues might drop, but programming continues using dollars from the district’s fund balance. This model also illustrates—based on our current expenditure and revenue patterns—when we believe our fund balance will be reduced to the district’s minimum threshold of 15%.

Building in Flexibility

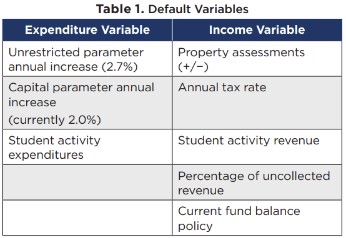

The foundation of the Ladue model includes two types of identified variables: a default variable and individual variables. A default variable is one that, when changed, affects all future calculations (see Table 1). An example of a default variable is our unrestricted spending parameter. The administration and the board could decide to increase or decrease a default based on changing economic indicators or an identified need. Using the model, we can analyze the long-term financial impact.

The model also allows for 33 individual variables to be changed manually to override the model defaults in any given year. Any change to these individual variables affects the fund balance for that year and may also affect future years.

The model is calibrated each year when the actual year-end data are entered after the fiscal year closes in June. The actual data override any default or individual variable for that given year. This is a vital step in updating the model and reevaluating long-term financial projections.

Clear Communication

The Ladue School District has experienced significant benefits in developing a long-term financial forecasting tool. Ten years ago, the tool provided the administration with a budgeting platform that allowed for measured expenditure increases while reestablishing a healthy fund balance. Today, the fund balance is healthy, and the model is useful in explaining the significance of the fund balance and the district’s long-term plan for spending down the reserves.

As federal funds associated with the COVID-19 pandemic dissipate and inflation rates continue to run high, we plan to increase expenditures while closely monitoring short- and long-term projections. As good stewards of tax dollars, we understand our model won’t yield perfect results, but at the very least, it provides our school community with an understanding of our philosophy and methodology of budgeting.